Currently browsing Budget and Economy Archives

A Happy Day at the Franchise Tax Board

April 18 was a happy day for state tax collectors as the Franchise Tax Board received $1.6 billion in payments – more than doubling the previous day’s $751 million.

Payment volume should continue to be high as the state sifts through the returns filed on April 17th, the payment deadline.

To date in April, the Franchise Tax Board reports collecting almost $3.9 billion — $4.5 billion less than Gov. Read more »

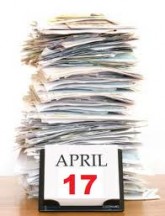

It’s Tax Day And the State Gets a Nice Revenue Bump

Not all Californians procrastinated paying their taxes by April 17.

The state reported collecting more than $751 million on the 17th – the highest single day of receipts so far this month.

Payment volume should spike even higher after the 17th.

To date in April, the Franchise Tax Board reports collecting more than $2.3 billion — $6.1 billion less than Gov. Read more »

State’s Daily Tax Receipts Begin End-of-the-Month Climb

With one day before April 17th’s tax filing deadline, the state reported receiving almost $455.5 million over the weekend, boosting the month’s collections to nearly $1.6 billion.

April is by far the largest month of the year for income tax receipts. Gov. Jerry Brown’s budget predicts $9.4 billion in both payments to the Franchise Tax Board and withholding from employee paychecks, which is sent by employers to the Employment Development Department. Read more »

Budget Hole Deepens, Increasing Importance of April Collections

Making April tax receipts even more important, revenues collected by the state in March were $236 million below the nearly $6 billion estimated in the budget, the state Department of Finance said April 13.

Since the beginning of the current fiscal year on July 1, revenues are almost $900 million below projections. Read more »

Tax Time Is Also Crunch Time for the State

This month, California taxpayers will be a major determiner of how deeply state services, including support for public schools, will be cut beginning July 1.

For obvious reasons, April is the state’s biggest single month for income tax collections. Budget writers are counting on over $9.4 billion

Counting all sources of taxes – sales, income and business – nearly $12.1 billion is expected to flow into state coffers by April 30, $100 million less than the nearly $12.2 billion predicted for June. Read more »

A State Refund Coming Back? Here’s 15 Places to Donate Some of It

It’s tax ciphering crunch time.

If there’s a potential refund coming, the state has created 15 options to donate some of that cash to various causes.

There’s one new tax check-off for 2011 to be found on Page 3 of the Franchise Tax Board’s Form 540. It’s a fund to help child victims of human trafficking. Read more »

New Year Off to a “Slow Start,” Gov. Brown’s Budget Writers Say

So begins the March Finance Bulletin from the Democratic governor’s Department of Finance. The next sentences read:

“Employment indicators were contradictory—a small loss of nonfarm jobs but the unemployment rate improved. Construction activity slowed, as did the real estate market.”

Elsewhere the bulletin notes that the median price of a single-family California home sold in January fell to $268,280 — down nearly 4 percent from a year earlier. Read more »

Economy on the Uptick But State Revenues Come Up Short

February revenues were $146.3 million below budget estaimtes, according to State Controller John Chiang’s monthly cash report released March 12.

Chiang attributed the shortfall to “a large increase in early tax refunds going out during the month of February.”

Nearly $100 million of the total came in lower-than-expected personal income tax collections for the month. Read more »

Inside California’s 11.1 Percent Unemployment Rate

California’s 11.1 percent unemployment rate is a statewide average.

The number of Californians working — or not working — varies by geography.

In Merced, the unemployment rate is 18 percent while in the Bay Area, it’s under 10 percent. Fresno has 16 pecent unemployment rate but Napa’s is only 8.5 percent. Read more »

The “Alarming” Rise in California’s Long-term Unemployed

At 11.1 percent, California has the highest unemployment rate in the country, next to Nevada.

That’s a little over 2 million Californians without jobs.

And more than one-third of them haven’t been able to find work for over one year.

Nearly half of those 2 million Californians have been without work for more than six months – an “alarming” trend according to a recent report by the Legislative Analyst on the state of the state’s economy and what that means for the budget. Read more »

Capitol Cliches Conversational Currency Great Moments in Capitol History News Budget and Economy California History Demographics Fundraising Governor Legislature/Legislation Politics State Agencies

Opinionation Overheard Today's Latin Lesson

Restaurant Raconteur Spotlight Trip to Tokyo Venting Warren Buffett Welcome Words That Aren't Heard in Committee Enough